Payment services for the aviation industry

Aviation companies need support from a payments provider with specific experience in their industry. With a FINCI multi-currency account we’ll help you fly funds around the world quickly and securely.

We’ve been featured in:

Fly higher with a FINCI business account

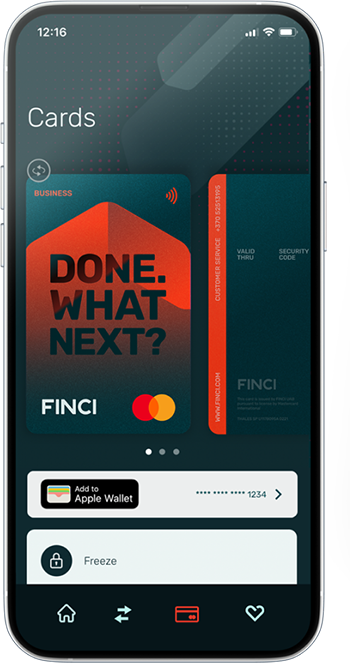

Pay suppliers instantly, so critical parts and services arrive on time, maximising aircraft safety and minimising downtime. Equip your globetrotting team with Mastercard debit cards for a seamless payment experience. Stay compliant with regional rules and international sanctions. And get support from a dedicated account manager that knows the aviation industry and your specific needs.

Payment networks for business

Get your tailored business account

Please fill out this short form and your account manager will start preparing a business account tailored to your needs.

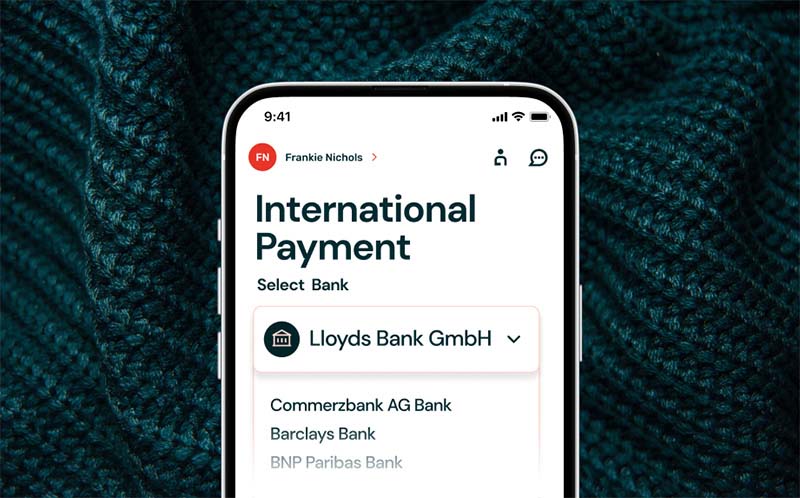

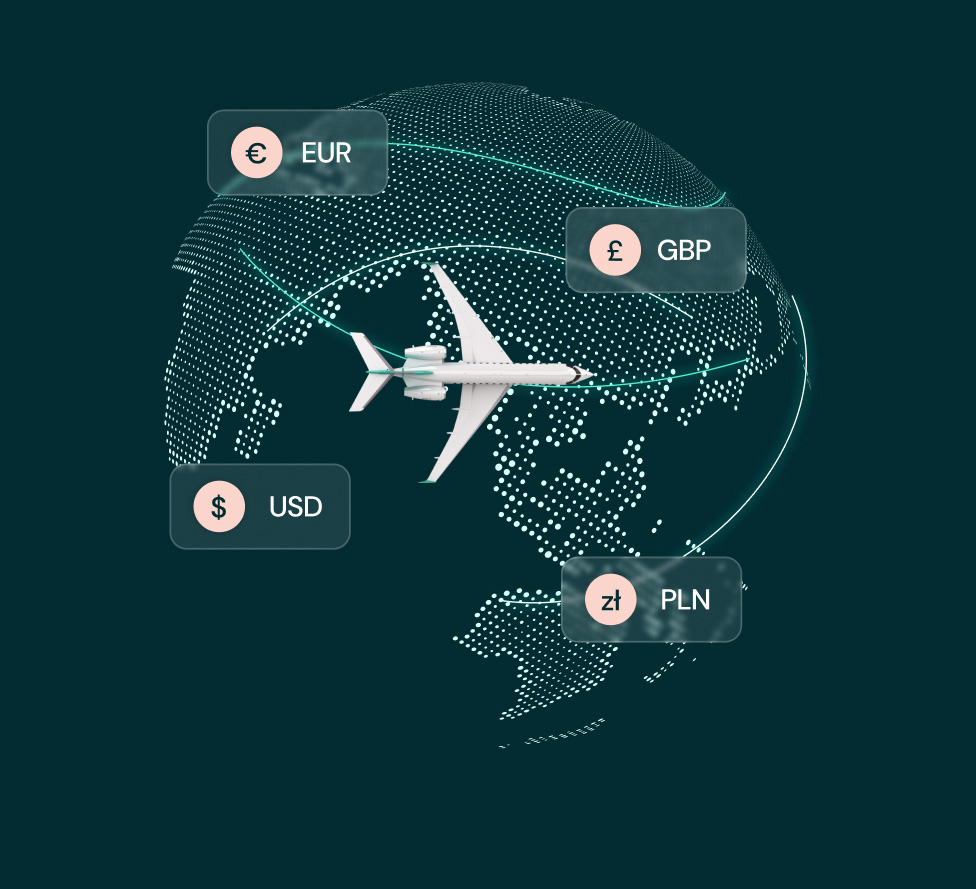

Make global

payments

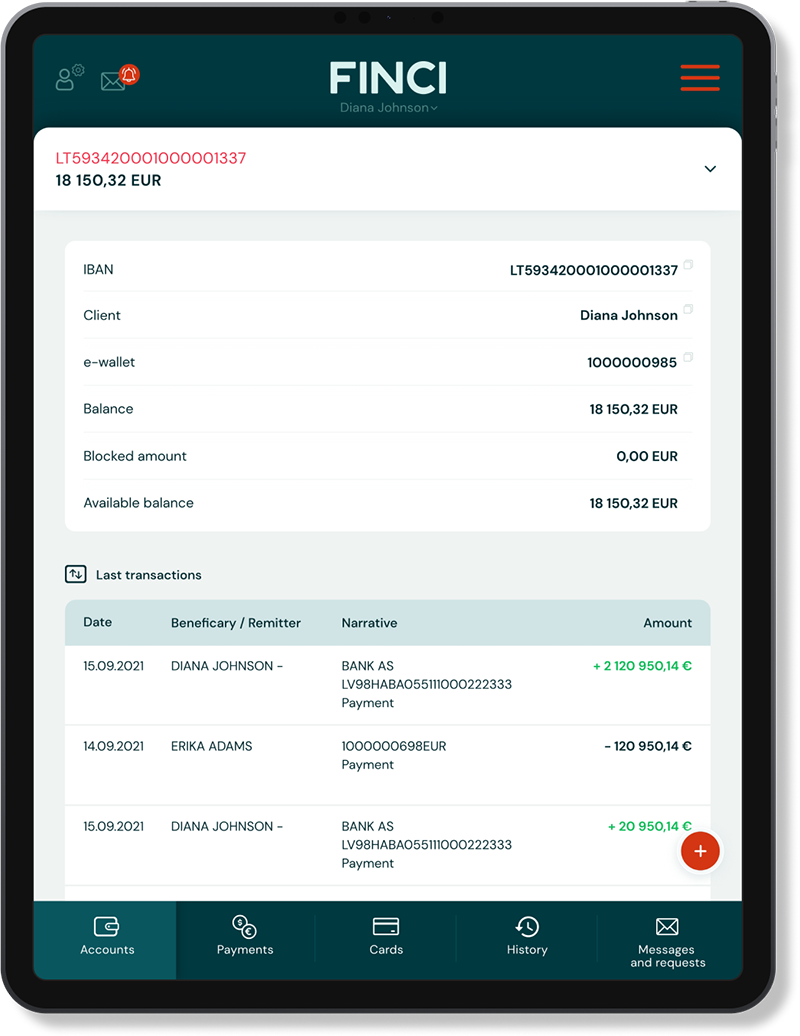

From one multi-currency business dashboard, you can send and receive payments in GBP, PLN, USD and EUR. Additionally, you have the option of making instant global payouts to a wide range of other currencies from your EUR account. With a suite of payment networks available, including SWIFT, SEPA, and SEPA Instant, your funds always get to their destination quickly and securely – just like the crucial parts and materials you need for on-time production.

Learn more

Making our clients in aviation happy

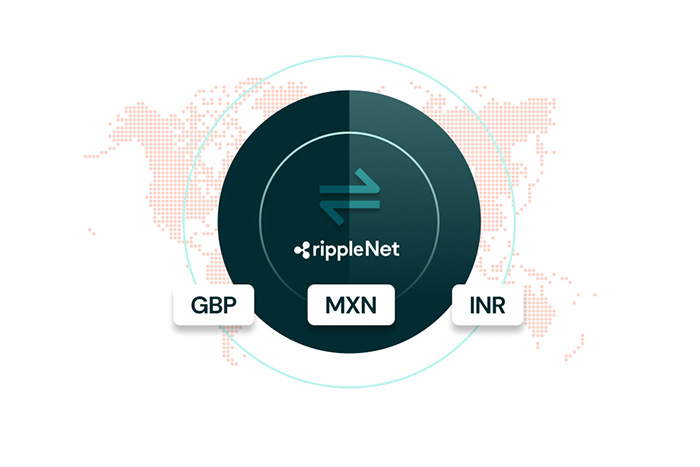

Instant payouts with RippleNet

Your jets fly fast. But your funds fly even faster with blockchain-powered payouts via Ripplenet. We provide instant global payouts to various currencies around the world. Trade with a specific region and want instant payments to that currency? Then please download this form and email to [email protected]. We’ll try to tailor a solution for you.

Fill out the formGet an account manager

Your aviation company is a complex business. So you need support that goes beyond apps and chatbots. You need quality human support. That’s why you get a dedicated account manager, someone that knows your industry, your business and your specific commercial needs.

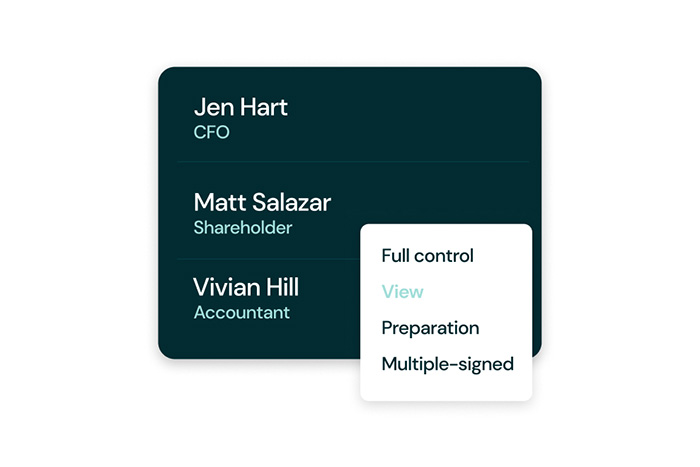

Gain control with user profiles.

Not everyone in your organisation needs the same access to your business account. To improve your internal risk management and gain more control, you can set different user profiles. With four types to choose from, you can assign different permission levels to allow your employees to perform different tasks.

Contact usYour aviation business can rely on FINCI payments.

Save money on

FX feesWhen you trade across borders currency conversions can be costly. With a multi-currency account you can avoid these expensive fees. And with the ability to hold balances in different currencies you can better manage company funds as they flow around the world.

Gain compliance

expertiseBusinesses in the aviation industry need a higher level of support from compliance. From AML to KYC, our team of expert compliance officers will support you as you trade across legal jurisdictions. And with specialist industry expertise, we know the right questions to ask as we guide you efficiently through the compliance process.

Building long-term stable relationships

We’re selective about the companies we work with because we give our business customers an extra level of service and care. Instead of serving millions of customers, we prefer to deliver exceptional service to those larger businesses that need more hands-on support. And as a result, we build rock-solid, long-term relationships with our clients.

Contact usComplex businesses

Our payments experts, with experience in aviation, really take the time to understand your business and meet your specific needs.

EU, Asia and USA

We provide seamless global payments, with direct SWIFT payment details to the EU, Turkey, UAE, Singapore, Hong Kong and the USA, etc.

Higher turnover

Experienced processing high-value, high-volume payments, we’re experts at serving larger companies turning over €500K to €50 million per month.

Make payments and track expenses at your desk or

on the go

Quickly and securely manage your business finances all within one app, wherever you are and whatever you’re doing.

Choose your business plan

Choose your business plan

| The first verification of Client’s documents |

| Account Opening |

| Unlimited multicurrency accounts |

| Free payments between FINCI accounts |

| International payments in foreign currencies |

| Free digital payment cards |

| Priority Customer Service |

Privacy and protection

Funds in your FINCI account are held safely and securely. As a regulated entity we are obliged to follow the strictest security practices. But on top of that, we have made additional investments to ensure that security of your funds and data is always our top priority.

Learn about security

Open a multi-currency account in hours

Our fastest time to open a business account is just 82 minutes. But that’s a record. It could take anywhere from a couple of hours to a couple of days.

Common Questions Common Questions

How do I open a FINCI business account?

How long does it take to open a business account?

Is there a faster way to open an account?

Can I maintain multiple currencies in my business account?

What’s the benefit to a private jet company of a multi-currency account?

Which payment networks do you provide access to?

How do these payment networks help my private jet firm?

Do you offer debit cards for our employees?

How can I request and manage payment cards for my team?

Are there any spending limits or controls for employee cards?

How does my account manager help my private jet company?

How can I get in touch with my account manager?

Is FINCI licensed?

How do I know my funds are secure?

Can you provide details about data privacy and compliance policies?

Do you charge any fees for opening a business account?

Can we connect to your API?

Can I add additional users for the account?

Business services for a better business

Get your tailored business account

Please fill out this short form and your account manager will start preparing a business account tailored to your needs.

Business account opening in 3 simple steps.

STEP 1

Create a free personal account via the app.

STEP 2

Log in to the online bank via desktop

STEP 3

Proceed with business account opening

Business account opening in 3 simple steps.

STEP 1

Create a free personal account via the app.

STEP 2

Log in to the online bank via desktop

STEP 3

Proceed with business account opening